Why Bitcoin?

Bitcoin is a form of money that is scarce by design, decentralised, and independent of any central authority. With a fixed supply capped at 21 million, it cannot be inflated at will, making it fundamentally different from fiat currencies. Anyone can use Bitcoin to hold and transfer value globally without permission, relying on cryptography and a distributed network rather than trust in institutions. This combination of predictable scarcity, censorship resistance, and self-custody makes Bitcoin a unique and powerful monetary system in the digital age.

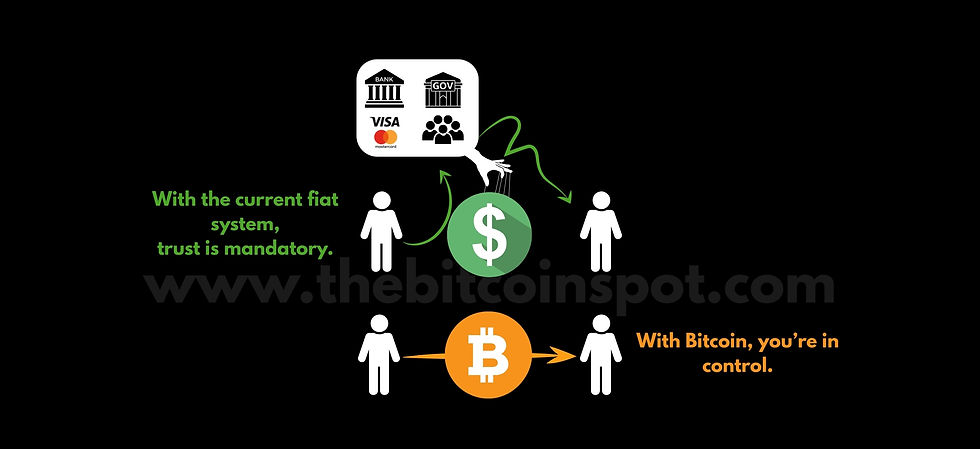

Reclaim your financial sovereignty with Bitcoin.

Bitcoin empowers users with financial sovereignty by enabling peer-to-peer transactions without reliance on banks or governments. Through its decentralised blockchain, users who control their private keys are granted full authority over their funds, free from third-party interference, such as account freezes or transaction censorship. This autonomy ensures that individuals can send, receive, and store value independently, restoring personal control in an era where fiat systems often impose restrictions and oversight.

A deflationary asset with a finite supply.

Bitcoin is a deflationary asset due to its strictly capped supply of 21 million coins, a limit hardcoded into its protocol. Unlike fiat currencies, which can be printed indefinitely, Bitcoin’s issuance is controlled by its algorithm, with new coins released at a diminishing rate through mining. Approximately every four years (or 210 000 blocks), the Bitcoin halving event cuts the block reward for miners in half, reducing the flow of new coins until mining ceases around 2140. This finite supply and predictable issuance schedule enhance Bitcoin’s scarcity, making it a deflationary store of value over time.

Bitcoiners don't trust, they verify.

Bitcoin operates on a system of verification, not trust, through its decentralised blockchain network. Transactions are validated by a global network of nodes using cryptographic protocols, ensuring their authenticity without relying on a central authority like banks or governments. Each transaction is recorded on an immutable ledger, verified by consensus among miners, eliminating the need to trust intermediaries. This trust-less system empowers users with confidence in the integrity of their transactions, secured by mathematics rather than institutional promises.

Security through

Proof of Work.

Bitcoin’s security is rooted in its robust code and protocol, which leverage cryptographic principles to protect the network. Its blockchain, a decentralised and immutable ledger, is secured by Proof of Work, requiring miners to solve complex mathematical problems to validate transactions. This process, combined with public-key cryptography, ensures that only the rightful owner of a Bitcoin wallet can authorise transactions. The open-source nature of Bitcoin’s code allows global scrutiny, minimising vulnerabilities and fostering trust in its resilient, tamper-proof design.

Divisible to 100 Million Sats, to start investing as little as $1.

Bitcoin can be broken down to 8 decimal places (0.00000001), which are called satoshis or sats. It's divisibility into 100 million satoshis per Bitcoin allows investors to purchase fractional units, making it accessible to those with limited capital. This granularity enables precise portfolio allocation, allowing investors to buy small amounts as Bitcoin’s price rises, reducing barriers to entry. Satoshis ensure that even as Bitcoin’s value grows, investors can participate in its long-term appreciation potential without needing to buy a whole coin. This divisibility also allows investment strategies such as DCA to be set up easily for any amount.

*Dollar-cost averaging (DCA) is an investment strategy where you regularly invest a fixed amount in an asset, like Bitcoin, regardless of its price. This spreads out your purchase cost over time, reducing the risk of buying at a peak.